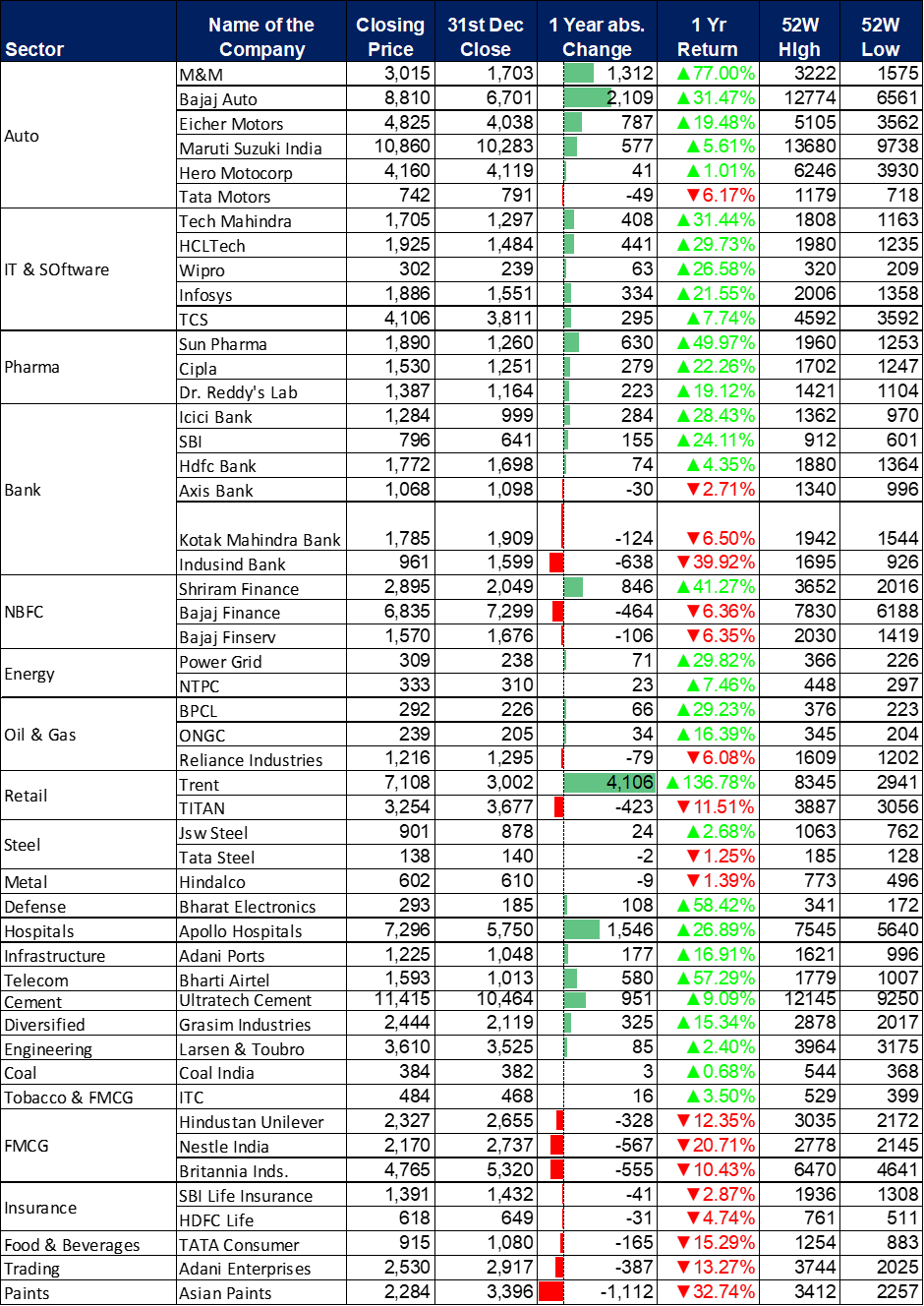

Nifty & Sensex

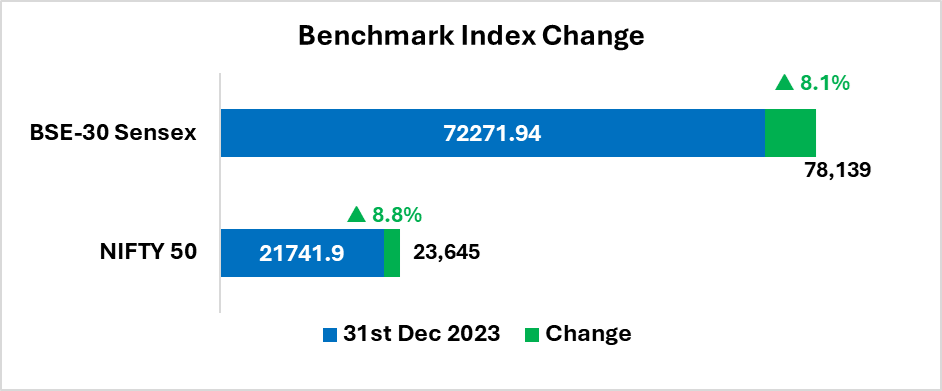

The year 2024 has been witnessed by several events globally that contributed to excessive volatility in the Indian stock market. Despite these fluctuations, the benchmark indices ended the calendar year on a positive note, delivering moderate returns to investors.

The Nifty- 50 index witnessed an impressive climb, rising from 21,742 to an all-time high of 26,277 on 27th September, reflecting a 20.9% increase. Similarly, the BSE Sensex surged to a record high of 85,978, registering a robust growth of nearly 19%. However, market could not sustain its peak level as the foreign institutional investors (FIIs) started offloading their holdings perceiving Indian stocks were overvalued. The selling pressure were driven by multiple Global factors such as fear of Iran and Israel war, economic stimulus package announced by the Chinese Government, policy rate cuts by the US Federal Reserve and lastly anticipation of protectionist measures from the incoming US President Donald Trump which raises fear of potential Trade War. The Nifty and Sensex experienced sharp correction of 11.1% and 10.0% respectively from their highest levels in last 3 months.

Courtesy: – National Stock Exchange and Google Finance

Change in Benchmark Indices

| Index | 31st Dec 2023 | Change | % Change | 31st Dec 2024 | 52W High | 52W Low |

| BSE-30 Sensex | 72,272 | 5,867 | 8.1% | 78,139 | 85,978 | 70,002 |

| NIFTY 50 | 21,742 | 1,903 | 8.8% | 23,645 | 26,277 | 21,137 |

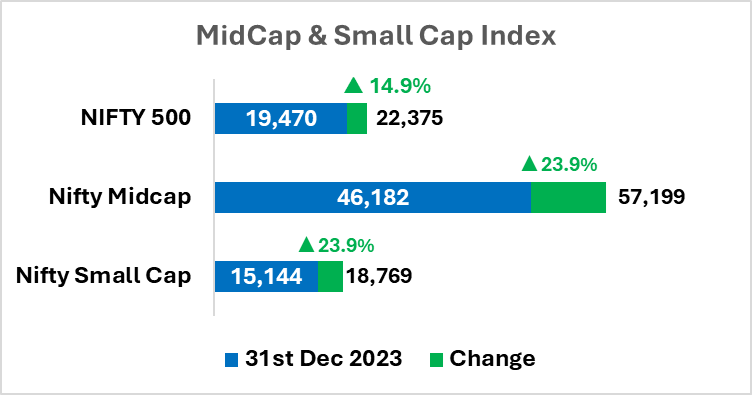

Midcap & Small cap Index

The comparatively risker Mid cap and Small Cap stocks outperformed the benchmark indices to deliver substantial return for the investors in the Calendar year 2024. The Nifty 500 outpaced benchmark indices and generated 14.9% return to end at 22,375. Meanwhile, Nifty Midcap 100 and Small cap 100 indices both posted impressive returns of 23.9% to arrive at 57,199 and 18,769 respectively at the end of 2024.

Courtesy: – National Stock Exchange and Google Finance

| Index | 31st Dec 2023 | Change | % Change | 31st Dec 2024 | 52W High | 52W Low |

| NIFTY 500 | 19,470 | 2,906 | 14.9% | 22,375 | 24,573 | 19,081 |

| Nifty Midcap | 46,182 | 11,018 | 23.9% | 57,199 | 60,926 | 45,293 |

| Nifty Small Cap | 15,144 | 3,626 | 23.9% | 18,769 | 19,716 | 14,085 |

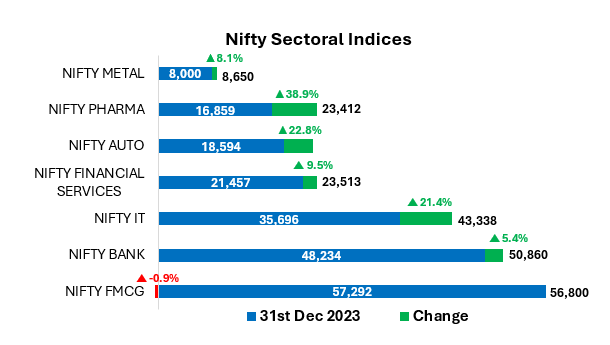

Sectoral Indices

Nifty Sectoral Indexes delivered with mixed performance in 2024, with some sectors outpaced the benchmark indices while others, such as Metal, Bank and FMCG sectors underperformed.

The Pharma companies emerged as standout performer among all sectors by generating an impressive 38.9% return followed by Auto Sector with 22.8% return. The IT sector has also done well in the last 3 months to generate 21.4% return. The Nifty Metal and Bank index posted 8.1% and 5.4% respectively while FMCG Index provided negative return despite achieving all time high of 66,439.

Courtesy: – National Stock Exchange and Google Finance

| Sectoral Indexes | 31st Dec 2023 | Change | % Change | 31st Dec 2024 | 52W High | 52W Low |

| NIFTY PHARMA | 16,859 | 6,554 | 38.9% | 23,412 | 23,908 | 16,819 |

| NIFTY AUTO | 18,594 | 4,240 | 22.8% | 22,834 | 27,696 | 18,143 |

| NIFTY IT | 35,696 | 7,642 | 21.4% | 43,338 | 46,089 | 31,320 |

| NIFTY FINANCIAL SERVICES | 21,457 | 2,056 | 9.6% | 23,513 | 25,202 | 19,822 |

| NIFTY METAL | 8,000 | 650 | 8.1% | 8,650 | 10,322 | 7,470 |

| NIFTY BANK | 48,234 | 2,626 | 5.4% | 50,860 | 54,467 | 44,429 |

| NIFTY FMCG | 57,292 | -493 | -0.9% | 56,800 | 66,439 | 52,399 |

How Nifty Stocks Performed in 2024

The bullish movement of the Automobile Stocks was evident while 5 out of 6 stocks delivered positive returns, while Tata Motors registered decline. As sectoral index indicated all 5 IT Companies generated positve movement led by Tech Mahindra and HCL Tech while TCS shows moderated growth. Pharma pack outperformed the index as a whole when Sun Pharma, Cipla and Dr, Reddy’s all posted positive returns on the other hand Banking and NBFCs showed mixed return. All FMCG companies including HUL finished in red that is in line with Nifty FMCG Index.